IDC adjusts its supply and demand forecasts for NAND flash

By TENCO in

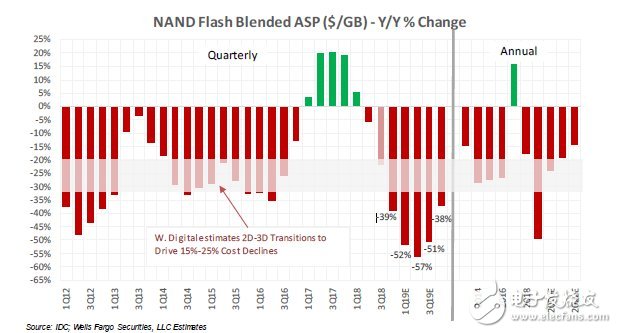

IDC adjusted its supply and demand forecast for NAND flash, saying that bit volume will increase 39 percent and 38 percent year-on-year in 2019 and 2020.And expect flash prices to slow down.

According to IDC, the average selling price of NAND flash memory (us $1 / GB) will fall by 54% in the first half of 2019, while the second half will be 45% lower than the same period last year.

Market supply and demand are the two main factors affecting the price of flash memory storage paid by customers.If supply exceeds demand, it may lead to overproduction and lower prices.

Annual change in the average selling price of NAND flash memory products (from the annual price change on the far right, the price decrease from 2020 to 2022 is slowing down)

IDC's forecast reflects expectations for bitcoin demand growth of 39 percent in 2019 and 38 percent in 2020, with average selling prices falling 50 percent in 2019 and another 24 percent in 2020.

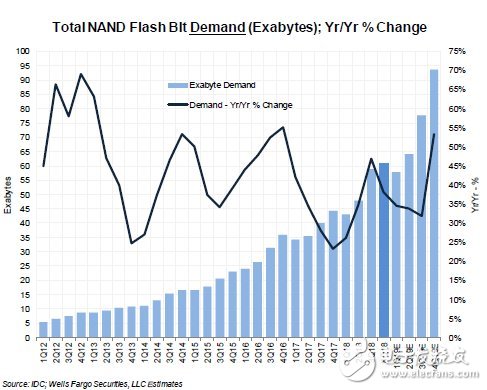

Annual change in total NAND flash bit demand (down from q3 2018 to q3 2019, but up straight from q4)

In terms of revenue, IDC now estimates the NAND flash industry will be worth $54.6 billion in 2018, down 4 percent from its previous forecast.Total revenue in 2017 was $48.6 billion.

In quarterly terms, revenue fell 19 percent in the fourth quarter of 2018, compared with a previously estimated 5 percent decline.Total demand for NAND flash bits rose 3.7 percent in the same quarter, compared with an earlier estimate of 15 percent growth.That means lower revenue at the end of 2018 and lower demand for bitcoin.

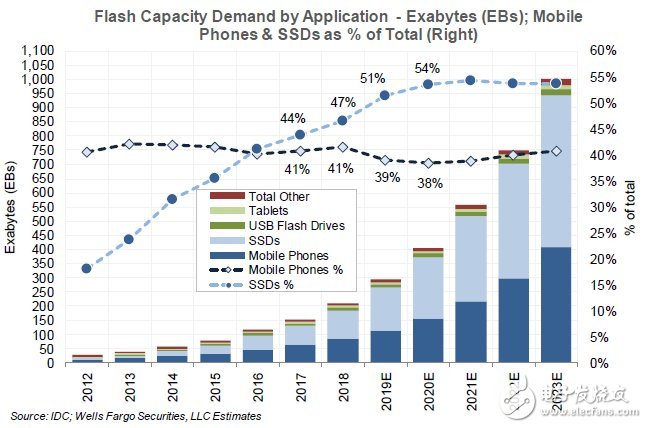

Industry demand for flash memory capacity (both SSDS and smartphones are on the rise)

But SSDS are an important part of the flash memory market, and total demand for flash storage has begun to stabilize at 54 percent, IDC said.After a slight slowdown in 2019 and 2020, smartphone flash storage demand is expected to gradually increase by 39-41% from 2020.